Phone: 503-565-2100 ![]()

Active vs. Passive: New Data

Submitted by Headwater Investment Consulting on September 9th, 2015By Kevin Chambers

Two basic types of mutual funds exist: active and passive. Passive funds, also called index funds, attempt to replicate the holdings of a specific index benchmark, for example the S&P 500. An S&P 500 index fund will buy the 500 stocks in the index and try to match the weighting. Active managers choose the stocks they think will perform the best and attempt to beat the index. The amount an active manger beats the index by is called alpha. At Headwater Investments, we tend to favor the passive investing approach; however, we do incorporate actively managed funds into portfolios for specific asset classes. For more information on why we favor index funds, see the Advantages of Index Funds.

One of the main databases Headwater Investments uses for quantitative and qualitative information on mutual funds is provided by a company called Morningstar. This summer Morningstar started producing a new report called the “Active/Passive Barometer” (APB) that compares the performance of active vs passive managers. This semiannually produced APB report measures active manager success by comparing the active returns against a composite of net of fee performance of passive funds.

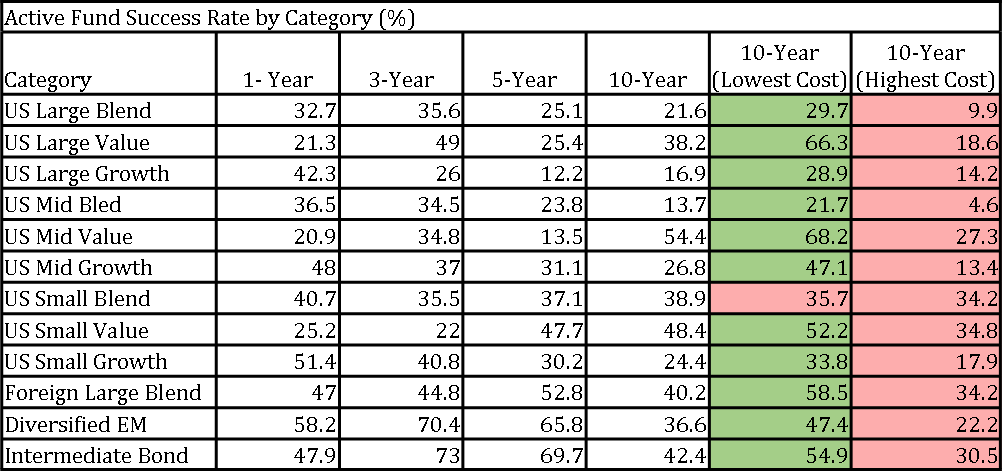

Above is the data set breaks down the relative performance of actively managed funds in each subcategory. Each of the numbers represents the percentage of active funds that performed better than the composite of passive funds. There are a few details to highlight in this first data release. First off, actively managed funds generally do not do as well as their passive counterparts. As time periods get longer, 10-years and beyond, even fewer actively managed funds beat passive.

The last two columns of the table show the lowest and highest quartile of funds sorted by cost. This shows that the lower fee funds in all but one category, US Small Blend, do better than the sample as a whole. In all of the categories, the funds in the highest fee bracket do worse than all the funds together. The report then goes on to break down each category into more detail. Here the Large Value category for an example.

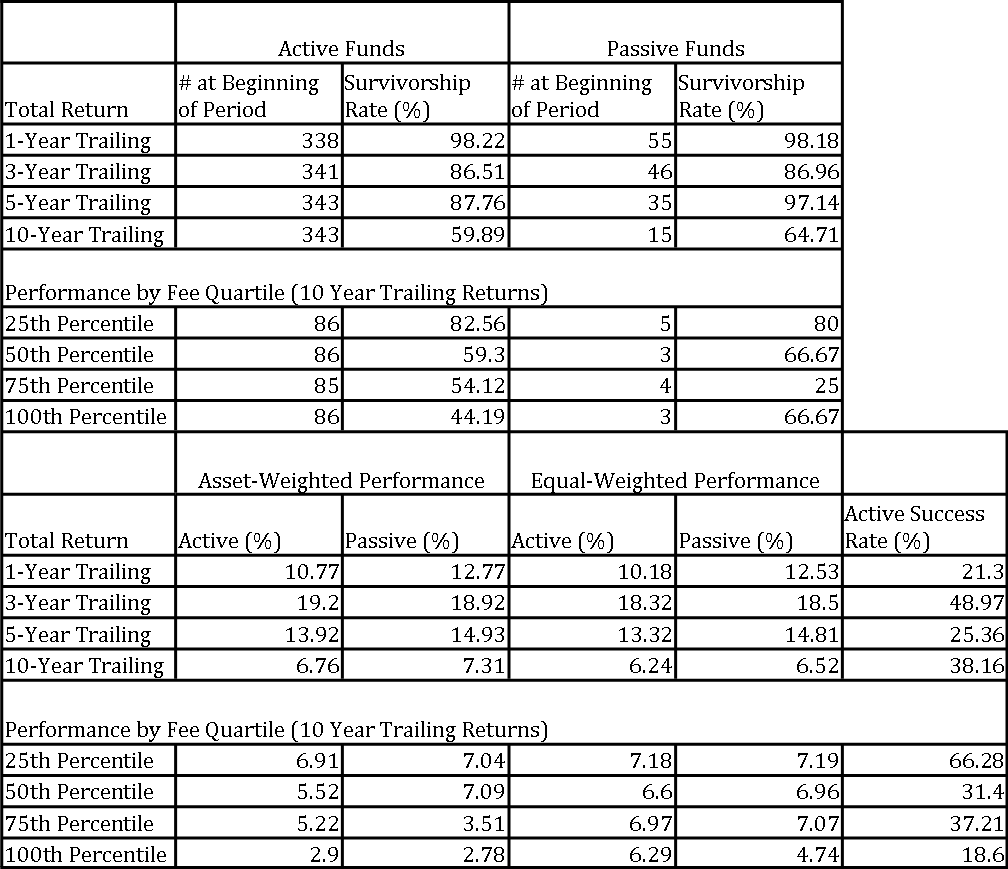

So let’s break down all of this data. The table is broken into two sections, historical returns and by fee quartiles. First let’s look at the first 4 columns. The Survivorship rate shows how many funds make it through the period. Morningstar calls the number funds that don’t survive “fund mortality rate.” Funds that don’t survive either close their doors or they merge or bought by another fund. In general, active managers have a lower survivorship rate than passive managers. When looking at fees, funds with higher fee have even fewer funds that survive. For large cap value, only 60% of active funds survived over 10 years, versus 65% of passive funds. The highest cost active funds have a 44% survivorship rate versus 83% for the lower fee funds.

The next interesting data point is the assets weighted performance. This is a relative gauge of how well investors are at choosing the well performing funds. This performance data shows that the funds with more assets (more investors) did better than the equal weighted returns. This is true for large cap value too. The asset weighted performance over 10 years for active funds returned 6.7% versus 6.2% for the equal weight.

This report will be something that Headwater Investments continues to monitor and use as a resource. The initial report confirms our strategy of favoring low cost index funds over actively managed funds. Our portfolios are built for long-term growth and income, and in the long term, it is clear that index funds are preferable. There are some active funds that do well over time, but knowing which ones are going to succeed is difficult to ascertain, making the risk too great. Actively managed funds in specialized asset classes, like emerging markets, make some sense. However, it is very important to only choose managers that have lower fees. If there is one main take away from this report it is that fees are the killers to portfolio returns. Regardless of the active versus passive debate, it is clear that lowering the fees on your investment portfolio will increase your odds of financial success.

For more information and the complete report, please visit Morningstar.