Phone: 503-565-2100 ![]()

Benefits of Saving Early

Submitted by Headwater Investment Consulting on March 9th, 2016By Kevin Chambers

When saving for retirement, time is your friend. The earlier you start saving for retirement, the easier it will be to have a significant nest egg. By starting early, you have more to time for your assets to grow and take advantage of compounding interest.

Example:

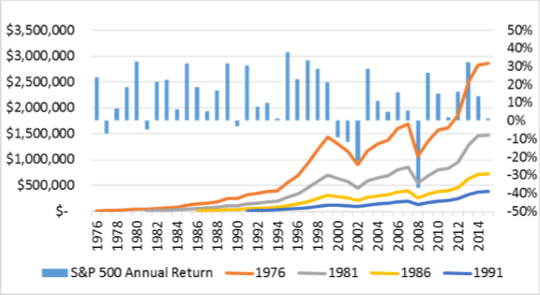

Let’s look at the last 40 years, and the difference in starting to invest at different times. The basis of this example is investing $5,000 a year, and investing your account in the S&P 500. As of the end of 2015, starting in 1976 versus 1991, a difference of just 15 years, yielded about $2.5 million more in retirement assets. In terms of retirement income, that is the difference between $12,000 and $1,600 a month. This time period includes two major market crashes: the internet bubble in the late 1990s and the 2008 financial crisis. Even with those negative years, those who invested early, have time to recover.

It is possible to make up for lost time by contributing more, but the amounts get increasingly large. To make up for waiting just 5 years, starting in 1981, to make the same amount as if you started in 1976, you would need to contribute $10,000 a year. That is a difference of $150,000 in contributions over the course of your working life. By waiting until 1991 to start you have to contribute a total of $750,000 more to end up with the same ending balance. Those are some big differences.

Many of our clients are already in or near retirement, so this post may be a little late for you. However, one of the best things you can do for the young people in your life is to talk to them about starting retirement accounts early. Putting some money away for retirement now and creating the habit of saving for retirement can make things so much easier in the future. At Headwater Investments, we are happy to meet with any young people who are interested in learning more about retirement planning, free of charge. Also, if you have questions about good ways to talk to the younger generation in your life about investing, we have some tips. Feel free to give our office a call to set up an appointment.