Phone: 503-565-2100 ![]()

Bond Update

Submitted by Headwater Investment Consulting on October 1st, 2015By Kevin Chambers

On September 17, 2015, the Federal Reserve once again decided to push back raising interest rates. This decision has spurred renewed speculation in the financial press about what will happen to bond investments when rates finally do end up rising. Let’s revisit the role of bonds in our portfolios and the possible effects in the long term.

Bonds are still doing what they are supposed to:

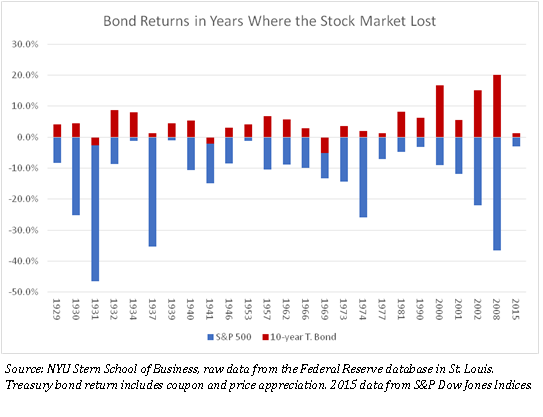

So far in 2015, the stock market has lost money, but bonds are expected to temper some of the loss in down stock market conditions. As of the end of August, the Standard & Poor’s 10-year treasury index is up 1.2%. The Barclays Aggregate Index, a more comprehensive index across all bond maturities, is up 0.5%. Although these numbers are not huge winners, US bonds have been one of the only asset classes that have made any money this year.

Higher Interest Payments Outweigh Losses:

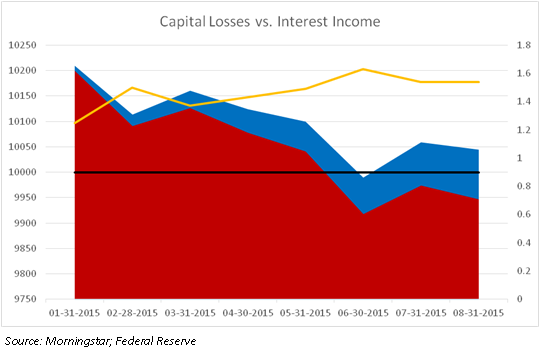

So far in 2015, interest rates have actually risen slightly. At the end of January 2015, yield was 1.25 for the 5-year treasury. That has slowly risen to 1.54 over the course of the year. As interest rates have risen slightly, the face value of bonds fell, as theory predicts. However, when you look at the total return, which includes interest payments, bonds are slightly up for the year. As interest rates rise, holding bonds will still be beneficial because the higher interest rates increase the income generated by bond investments.

Downside is minimal:

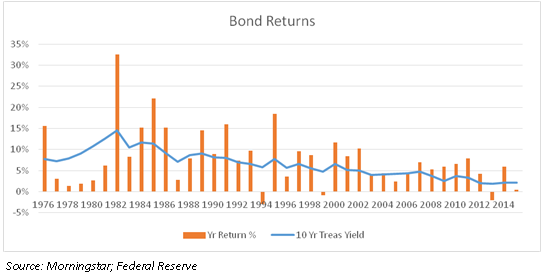

Historically, bonds have been safe investments. Since 1976, interest rate environment has shifted several times. Bonds have only lost in 3 years, with the biggest downside being -3% (1994). Compare that with the stock market, which over the same time period lost in 7 years with the biggest drop being -37% (2008). Although bonds have not been huge money makers in recent years, they have been consistent performers with limited downside risk.

Duration risks:

One of the main risk factors bond investments face during a possible rising rate environment is duration risk. Duration is the sensitivity of the price of a bond to a change in interest rate. Duration is a complex formula that takes into account many different bond indicators such as: present value, yield, coupon, and final maturity. Duration is expressed as a number of years. The higher the duration number the greater the risk exposure during interest rate fluctuations. As part of our on-going due diligence process, we monitor the duration risk of all our bond funds.

Conclusion:

During rising rate environments, bonds can be slightly more volatile, making it an unsuitable time to tactically trade in and out of the bond market. The best thing to do is get your portfolio set appropriately for your risk tolerance and financial situation and ride through the rising rates. When choosing bond investments, it is important to do your due diligence on the risks the portfolio managers are taking. Although bonds are considered safe investments, they can still lose money. Often higher duration funds get better yields, so it is important to make sure your bond investments are not overly risky.