Phone: 503-565-2100 ![]()

The Chinese Stock Market

Submitted by Headwater Investment Consulting on July 23rd, 2015By Kevin Chambers

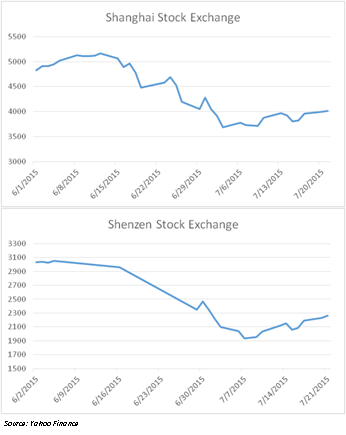

The Chinese stock market has been making a great deal of headlines in recent weeks. Unfortunately, the coverage has been about the turmoil on the exchanges. From June 12th to July 8th, the Chinese stock market dropped about 30%. The market has since rebounded, due to Chinese government action earlier this month. Then, in the last week of July the market in China crashed again. Perhaps a little background on the Chinese stock market will help explain why it has been so erratic.By Kevin Chambers

The Chinese stock market has been making a great deal of headlines in recent weeks. Unfortunately, the coverage has been about the turmoil on the exchanges. From June 12th to July 8th, the Chinese stock market dropped about 30%. The market has since rebounded, due to Chinese government action earlier this month. Then, in the last week of July the market in China crashed again. Perhaps a little background on the Chinese stock market will help explain why it has been so erratic.

In the post-communist era, China has two major stock exchanges: The Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE). As of June 30th, the SSE is the 3rd largest market in the world, behind the NYSE and NASDAQ, with a market capitalization of $5.7 trillion (USD). SZSE, with a market cap of $3.9 trillion (USD), is the 6th largest exchange behind Japan and London. Both of these Chinese stock exchanges are fairly young when compared to their global counterparts. Both markets officially began trading in 1990, after the transition from strict communism opened up investment markets. Traditionally, the SSE has acted more like the NYSE, trading the large cap, big name stocks. Many of the stocks are Chinese government owned entities, including big banks, construction conglomerates, and oil and gas companies. The SZSE, more comparable to the NASDAQ, has included more start-up private sector tech companies (Hunter & Wong, 2015).

You may be wondering why I have not included the Hong Kong Stock Exchange (HKEx) in the list of Chinese stock exchanges. HKEx is the 7th largest exchange in the world, right behind SZSE, with a market cap of $3.8 trillion (USD). Although technically part of China, Hong Kong operates under a different legal system than the rest of China. Therefore, the HKEx has allowed foreign investors, which now make up a significant part of its trading volume (Hunter & Wong, 2015).

Since their inception, the SSE and SZSE have been almost entirely closed to foreign investors. The government has allowed some major institutional investors access, but only under a strict trading quota restrictions. Soon after the opening of the SSE and SZSE in 1990, many of the largest Chinese Government owned companies listed on the SSE also issued H-shares, which traded on the HKEx and allowed foreign investors to purchase them. Then in November 2014, the Chinese government and HKEx announced a program called the Shanghai-Hong Kong Stock Connect. This program allows Chinese investors to buy stocks listed on the HKEx as well as allows Hong Kong investors, and therefore the rest of the world, to buy stocks on the SSE. Goldman Sachs estimated that this added more than 800 companies and over $1 billion (USD) to the investable market universe for US investors (Lau, Moe, Bei, & Liu, 2014). SZSE is expected to be added to the connect program soon.

Along with the connection to the HKEx, the Chinese Government has relaxed their requirements for “mom-and-pop” investors putting their money in the stock market. These two factors have increased the number of people buying Chinese stocks, and led to the huge boom the markets have seen up to June of this year. From June 2014 to June 2015, the SSE’s market cap is up 137% and the SZSE is up 156%. That is a lot of new money flowing into the Chinese stock market.

However, it is still clear that the government has a lot of power to manipulate the markets, and does so blatantly. Although the Federal Reserve and the US Government have power to move the US markets, they do not typically intervene with a company’s or an individual’s ability to make investment decisions. During the last month, there are reports of the Chinese government ordering companies to buy stock, loaning investors’ money to buy more stocks, and limiting trading on many state run companies. The Wall Street Journal reported that at one point only 3% of stocks on the SSE and the SZSE, about 93 of the total 2879 companies, were trading freely on the markets (Hunter & Ma, 2015).

Although China continues to grow in importance in the global political economy, the country is still considered to be an emerging market. This is evident in how its stock exchanges are operating. They are still young and undeveloped. As the exchanges open to new foreign investors, and as the domestic populace has more money to add to the market, the inflows of capital are going to create unstable positions. Continued big swings in the market should be expected as money floods the exchanges and market capitalization rises. The Chinese government is still largely propping up the value of the markets and many of the companies in the market. If the government continues the trend of liberalization toward freer markets and privatization, market turmoil will undoubtedly be experienced through the transition. The Chinese stock markets have historically been volatile, and investors can expect that trend to continue for the foreseeable future.

Works Cited

Hunter, G. S., & Ma, W. (2015, July 21). China’s Market Plunge: Where Only 3% of Firms Could Trade. Wall Street Journal.

Hunter, G. S., & Wong, J. (2015, July 10). Everything You Need to Know About China’s Stock Markets. The Wall Street Journal.

Lau, K., Moe, T., Bei, B., & Liu, C. (2014). SH-HK Connect: New regime,unprecedented opportunity. New York: Goldman Sachs.