Phone: 503-565-2100 ![]()

How the French Election Could Affect Your Portfolio

Submitted by Headwater Investment Consulting on May 17th, 2017

By Kevin Chambers

Over the first weekend of May, Emmanuel Macron was announced the victor in the presidential election in France with over 60% of the vote, demonstrating the commitment of the French people to the European Union and providing an encouraging sign for European companies. We will take the time to look back on the last few years of European investments and what we can expect for the future.

European Union

The European Union is an organization of 28 countries. It is an agreement to share political and economic legislation. The EU makes up 7% of the global population; however, the EU accounts for 20% of global trade (The Economy, 2017). The GDP of the EU is over $16 trillion, just behind the United States, making it the second biggest economy in the world and an important economic hub for the world.

Recent Economic History

The recent economic history of the EU can be boiled down to three major events. First was the 2007-2008 crisis. Europe suffered more from the 2008 financial crisis than the US and other developed nations. While the US stock market lost 37% and the Japanese stock market lost 29%, the EU markets lost 46%. The second was the European credit crisis in 2011. Greece, Portugal, Spain, Cyprus, and Ireland all faced collapsed and needed to be bailed out of debt. Finally, the recent announcement of the UK leaving the union. These events, one after another, have hampered European growth over the last 10 years. Europe lags behind most other developed nations, including Australia, Singapore, Hong Kong, The US, and Japan.

Compounding the problem to some degree, the most financially successful European country recently has been Switzerland, which is not part of the EU. In previous blog posts and papers, we have reviewed the different crises and explained their outcomes as well as looked at specific markets and the challenges they face. Here we will consider the current state of Europe after the French election.

OTHER CRISIS AND MARKET ANALYSIS

Japan Outlook 06/15

China Stock Market 07/15

Brazil 03/16

American Household Debt 04/16

Student Loan Update 5/16

Brexit Update 06/16

Greek Eurozone Exit 07/16

Housing Trilemma 04/17

Interest Rates

Interest rates in Europe remain very low. German 10-year bonds are below 0.50%. For comparison, US 10-year bonds are closer to 2.5% despite dealing with low-interest rates. Interest rates in the strongest countries in Europe, mainly France and Germany, have remained very low. With uncertainty in stock markets, investors have fled to the safety of French and German Bonds, driving down their interest rates with price demand. Bond-buying programs and interest rate management by the European Bank has also contributed to the low rates. As European recovery continues to improve, we expect interest rates to rise, just like we have seen in the US.

Stock Market Returns

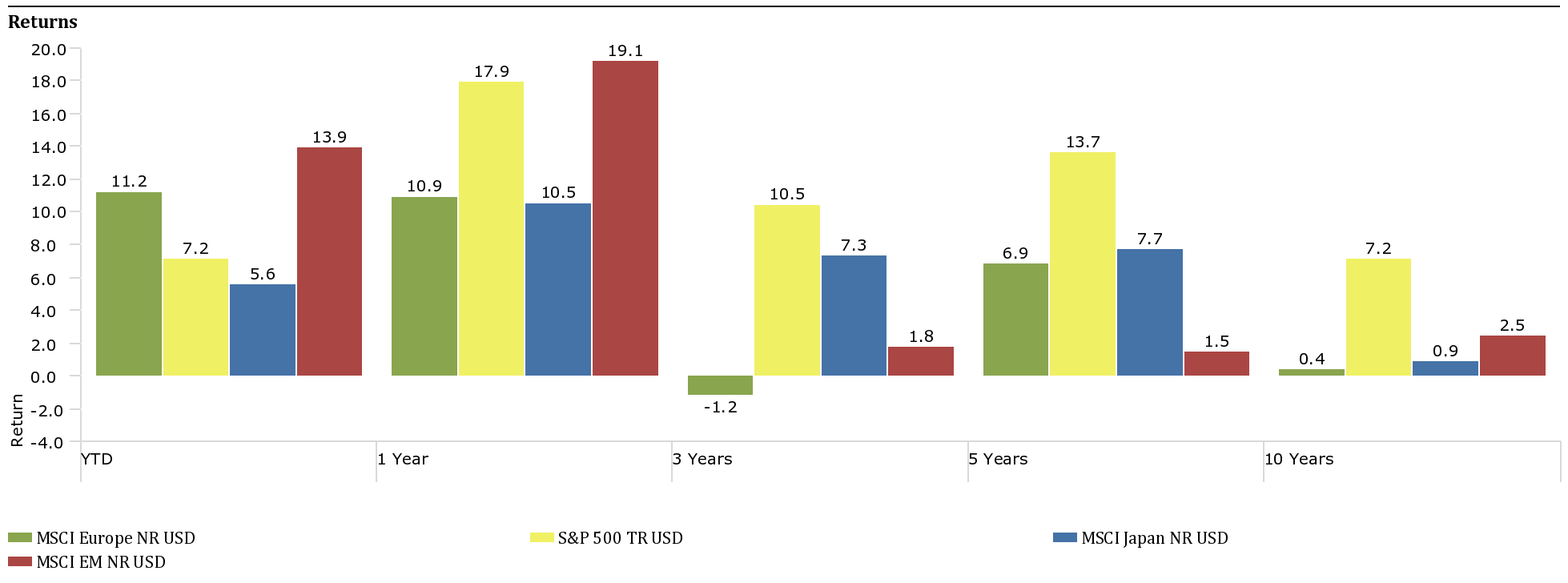

Over the decade, European markets have underperformed other stock markets. The MSCI Europe index, which reflects the stock markets of Europe including Switzerland and the UK, has returned 0.4% annually over the last 10 years. That is compared to 7.2% in the US, 0.9% in Japan and 2.5% for Emerging markets.

The four largest and most important financial markets in Europe are Germany, France, Switzerland, and the UK. They are the drivers of financial success in Europe, which is no surprise. On the other side of the equation, the PIG countries (Portugal, Ireland, and Greece) have lagged behind the rest of the continent.

Outlook

Regardless of the outcome of the French election, EU involvement is still going to be a debate in France and the rest of Europe. Multiple social and political issues surround the continued unity question. Immigration and national sovereignty were the main issues brought up in the Brexit debate. The relationship between Europe and the UK will be a good barometer going forward. The British are working hard to maintain many of their economic ties to Europe while maintaining their ability to control domestic policy. At Headwater Investments, we are watching this situation carefully.

Although international equities and fixed income have underperformed their US counterparts, they remain important diversifiers. European companies remain important to the global economy. As interest rates rise in Europe, the bond payments will increase as well. Furthermore, as the US economy continues to improve, Europe is expected to follow. While there are scenarios where the US economy could move independently from the rest of the world, we are committed to including both international equities and fixed income as part of our diversified portfolios.