Phone: 503-565-2100 ![]()

Market Volatility 2016 – End of January update

Submitted by Headwater Investment Consulting on February 3rd, 2016By Kevin Chambers

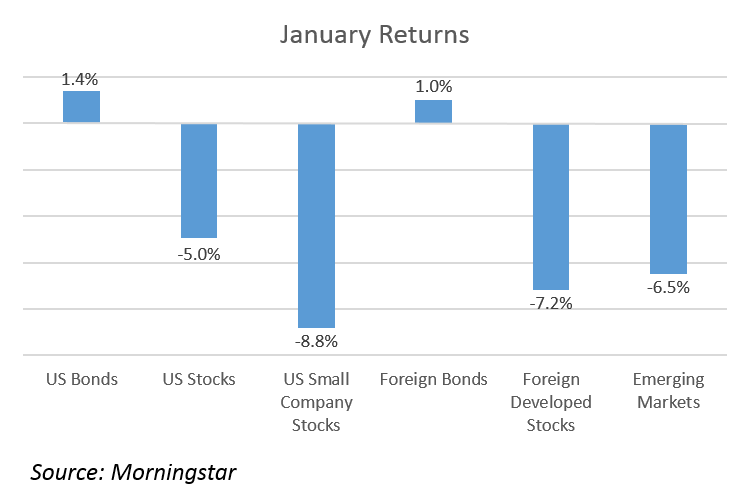

As many of you know, the financial markets have given us a volatile start to 2016. Foreign and US stock markets showed a general declining trend in January, mostly reacting to headlines concerning China and oil prices. In the United States, the stock market fell 5.0% (S&P 500) for the month. Foreign stocks fell 7.2% (MSCI EAFE) in developed countries and 6.5% (MSCI EM) in emerging economies. However, bonds fared well as investors flocked to safety. US bonds were up 1.4% (BC Agg) in January and Foreign bonds were up 1.0% (Citi WGBI). Although no one likes to see declines in the stock market, this movement seems largely reactionary and not a sign of fundamental weakness in the economy.

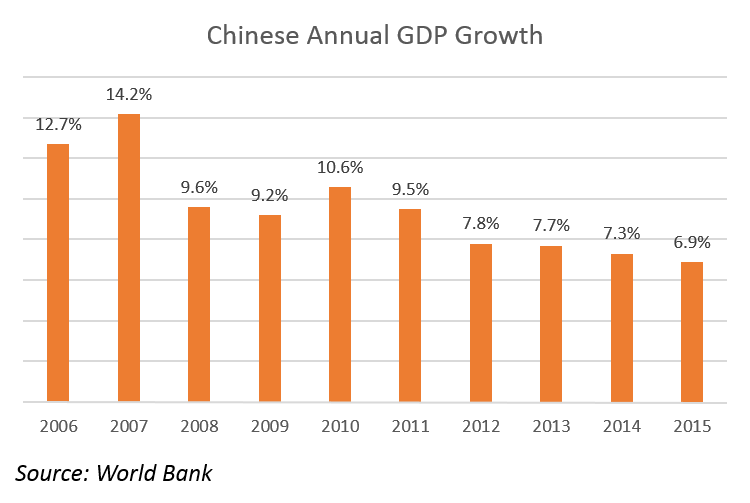

First, let’s look at China. Investors worldwide were concerned by a precipitous drop in the Shanghai Stock Market and the announcement that Chinese GDP growth fell below 7% in 2015, the first time in 25 years their growth numbers were this low. Although 6.9% is very close to the government target of 7%, this milestone drew headlines across the world. While the fall below 7% doesn’t indicate a deviation from the slow declining trend China has had since 2012, the indicator is causing investors to worry. As discussed in our blog entry last July, the Chinese stock markets are relatively new, very popular with the Chinese middle class, and not a reliable representation of the actual value of the companies due to substantial government intervention and involvement. Therefore, the major Chinese stock markets are more of a casino than an actual marketplace (Chambers, 2015).

In terms of the growth numbers, the major worry is that as China consumes less, it will have ramification on US trade. However, the Wall Street Journal reported earlier this month that US exports to China made up less than 1% of total US GDP. Thus Chinese consumption should have a negligible effect on US growth. Even when adding the spill-over effects to other emerging economies, the projected negative effect on US growth is less than 1% (Blinder, 2016). Although China is a major global player, their growth is still one of the highest and most consistent in the world. It is dropping, and everyone should pay attention to their economic changes, but the current effect on the United States should not be exaggerated.

Falling oil prices is another concern. The continued fall in prices has been mostly due to an oversupply. Last year the middle eastern countries, led by Saudi Arabia, decided to not cut back production to protect prices, and Iran has entered the global market. This was to hopefully run the newly established fracking companies in Canada and the US out of business. This tactic has worked to some degree as many regions dependent on the shale oil industry have seen some economic hardship. In total, the oil and gas extraction industry make up about 0.00125% of total US employment. Although supply has increased, demand has stayed relatively stable. Chinese oil demand actually increased in 2015, even with the drop in growth (Ip, 2016).

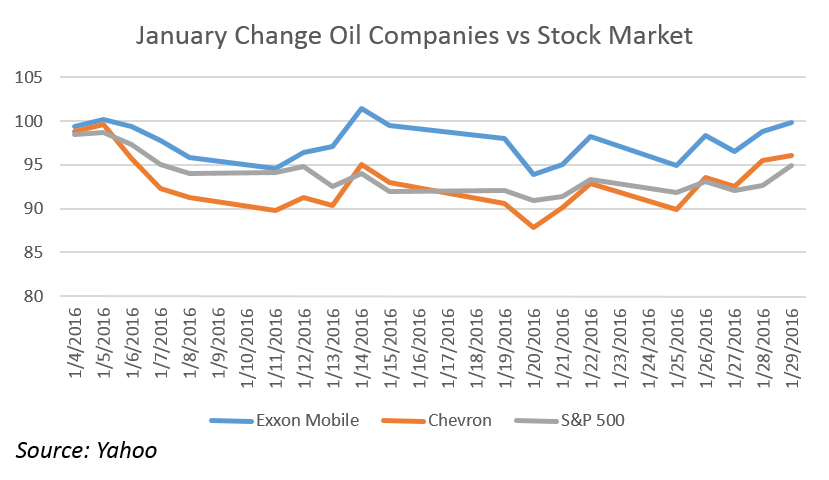

In theory, low oil prices should be a wash for the US economy in the worst case and a boon in the best case. Even with the explosion of fracking technology, the United States was still a net importer of oil in 2015. Low oil prices should be very bad for the economies of Venezuela, Brazil, and Russia, who rely on exporting oil to run their economy. However, lower prices in the US should, in total, be better for US companies as one of their vital inputs is now cheaper. It will also help other major oil importers, such as China and India. Nonetheless, US oil companies feel the pain of lower prices on their products. Major energy companies make up about 6% of the capitalization of the S&P 500. Their stock market decline has not been that different from the stock market as a whole. Exxon Mobil and Chevron, the two largest oil companies in the United States, make up about 3% of total S&P 500 market cap, or roughly half of the US oil market. Exxon lost 4% in January; Chevron has lost 9%, not too far off the S&P 500. JP Morgan predicts that low oil prices will contribute a net 0% to the US economy, with the positive and negative effects balancing each other out (The Economist, 2015). The real questions are whether or not this balance is extended to the rest of the world, and if the benefits to importers outweigh the negative effects of producers.

Going forward, there are a few possible outcomes that we at Headwater Investments envision. Most likely, the American economy will muddle through this coming year. Especially when compared with the rest of the world, the US looks strong. Unemployment has remained low, wages are slowly increasing, the housing market has regained strength, and US companies are continuing to contribute positive earnings. The main reason the Federal Reserve decided in December to increase interest rates is because they finally thought the US economy was strong enough to handle it. There is always a chance that this could be the start of a new recession though the indicators do not point to this being the case. If we are headed for a recession, it might be hard to recover because the main tool the government uses to help the economy, lowering interest rates is still not an option.

Investors often have short memories. This current stumble in stock markets looks very similar to the brief fall we had in the summer of 2015. The markets reacted negatively to news out of China, the Federal Reserve announcements, and consistently low oil prices. The stock market fell about 7%. Sound familiar?

Here are two important lessons to remember from this summer. First, the stock market made back all of the losses during September and October, ending the year up slightly. For those people that worried and sold their stock in August, they missed the quick rebound in the fall. Secondly, through both declines, diversification has worked. Bonds have continued to be the place where investors put money in times of volatility and uncertainty. Well-balanced portfolios have weathered both storms appropriately by tempering stock market losses with fixed income stability. Although seeing market and portfolio declines are never welcome reality, staying patient and not acting rashly is the best during these periods. There are some obvious unknowns going forward, and 2016 is sure to be an interesting year. In investing, it is important to have a long-term approach and know that over time, with a globally diversified portfolio, all of this volatility will smooth out.

Blinder, A. (2016, January 20). Markets Are Scaring Themselves. The Wall Street Journal.

Chambers, K. (2015). The Chinese Stock Market. McMinnville, OR: Headwater Investment Consulting.

Ip, G. (2016, January 20). Markets’ Panic Incongruent With Economic Reality—For Now. The Wall Street Journal.

The Economist. (2015, January 23). Oil and the Economy. The Economist, pp. 17-19.