Phone: 503-565-2100 ![]()

Money Market Accounts: A Bank vs Brokerage

Submitted by Headwater Investment Consulting on May 2nd, 2018By Kevin Chambers

At your local bank, there are many different types of accounts you can open: checking, savings, CDs, or money market. In your brokerage account, for example at Fidelity Investment, cash is invested in a money market fund. While each of these types of accounts have advantages and disadvantages, let’s look at

the three main differentiators between them: the interest rates you can earn, the limitations placed on the account, and the amount of insurance placed on the account.

Source: FDIC Weekly National Rates as of April 30th, 2018; Morningstar

Interest Rates:

The amount of interest varies significantly for these different accounts. In the wake of the 2008 financial crisis, the Federal Reserve decreased interest rates in the United States to essentially zero in the hopes to encourage spending. In the last year-or-so, interest rates have started to inch upward but not by much. The average rate for checking accounts is 0.05%, and the average for savings is 0.07%. Money market funds at brokerage houses are paying the highest interest. For example, the current rate is 1.32% for the Fidelity Money Market Fund.

Withdrawal Restrictions:

The difference in interest rates between the accounts at banks is tied to how restrictive the accounts are. Savings and Checking accounts are the most liquid. Since they are the easiest to get money out, they have the lowest interest rates. The harder it is to get your money out, the higher the interest rates you receive. For example, CD’s tie-up money for 3-months to 5-years. The longer the length of the CD, the bigger your interest payments.

Insurance

All accounts at banks in the US are protected by the Federal Deposit Insurance Corporation (FDIC). The FDIC was created after the numerous bank failures during the Great Depression to give people confidence in the safety of the banking system. For your account at a bank, the FDIC will protect the first $250,000, in the event that your bank goes out of business. At brokerage houses, the insurance is guaranteed by a different organization called the Securities Investor Protection Corporation (SIPC). They also offer $250,000 of protection for cash products (like money market funds). Some money market funds also have a second layer of protection. Many of them buy short-term government bonds as the basis of their holdings. Therefore, the owners of money market funds also gain the backing of the US Government. The Government would have to default on their debt for these products to be unviable.

Making a choice:

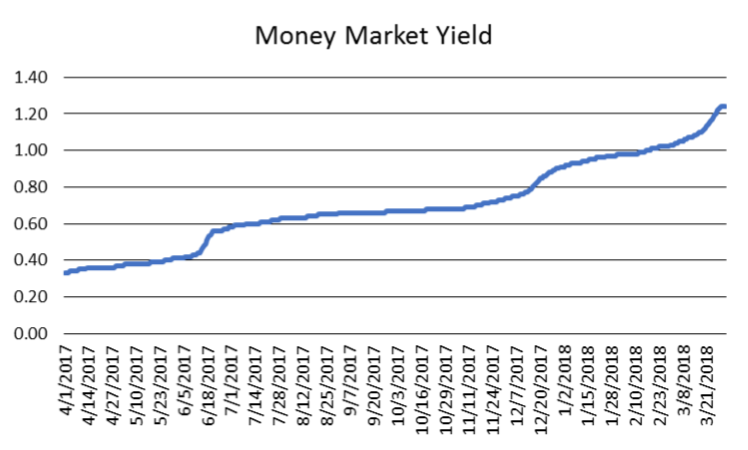

With the historically low-interest-rate environment we are still facing, being able to find yield is important. Interest rates have been rising for money market funds steadily over the last two years.

Source: Yields for SPAXX from Morningstar

Bank rates, however, have stayed relatively low. After the financial crisis, both money market accounts and bank accounts were paying essentially zero. Now a money market fund is paying much more. There are advantages to having checking accounts. The ease and liquidity are unmatched. However, funds that are earmarked for longer-term savings can be held in accounts with tighter withdrawal restrictions and receive a higher interest rate. Right now, there is not a compelling reason to buy a CD or invest in a money market account at a bank. Instead, an argument can be made for using a money market mutual fund. There is the same amount of insurance protection and you get a higher yield with more liquidity versus the bank alternatives. Obviously, all financial decisions are unique to each individual or family. Consult your financial advisor or accountant if you have any questions.