Phone: 503-565-2100 ![]()

Morningstar Style Box

Submitted by Headwater Investment Consulting on April 24th, 2019

By Kevin Chambers

Much of our investment data is pulled from a company called Morningstar. It is one of the biggest providers of analysis and data for advisors and managers around the world. One of their most famous innovations is called the Morningstar Style Box. It is a visual representation of how an individual stock (or a complete equity portfolio) compares to the rest of the market.

First, let’s think about an individual company. The Morningstar Style Box has two axes. The vertical axis ranks the companies by their size. This is pretty straight forward. It just looks at the market capitalization (a fancy way to say how big the company is) and ranks them from small to large.

Across the bottom, the horizontal axis ranks the stock by value vs growth. Growth stocks are riskier, higher priced, and have more potential for return. Value stocks are priced lower, have less risk, and lower return expectations. To illustrate the differences, let’s compare the extremes.

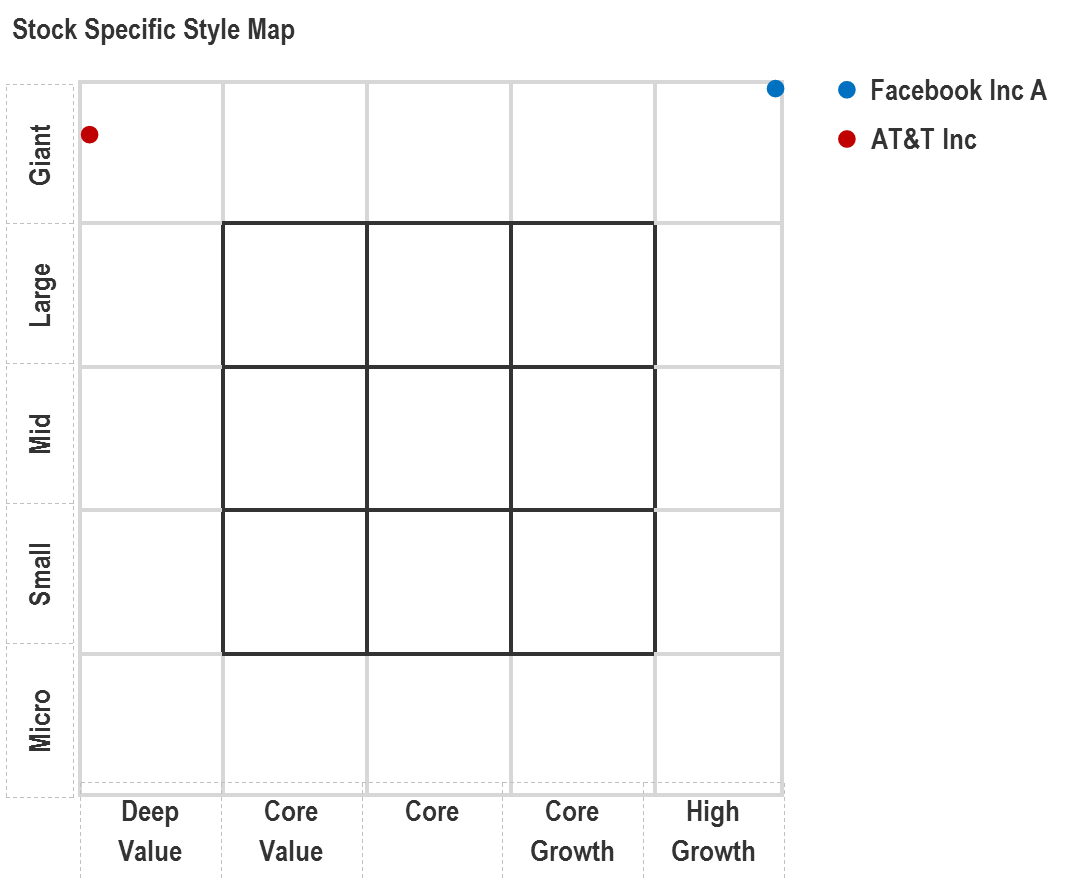

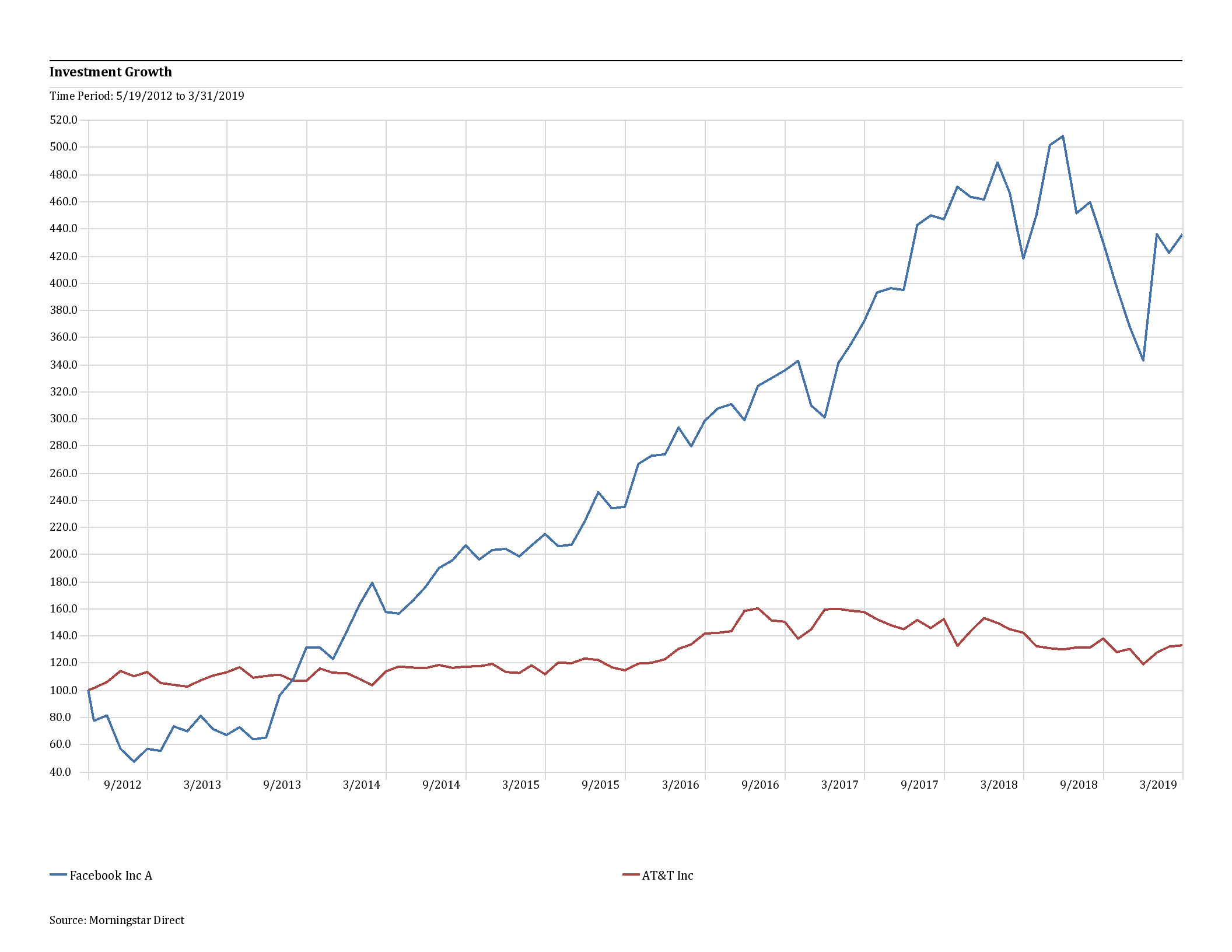

Two companies: Facebook and AT&T. Both household names. Both huge companies. Facebook is a growth company, but AT&T is considered to be a value stock.

While both are at the top of the vertical axis, they are basically off the charts in either direction, illustrating their difference in value vs growth. Looking at their performance over the last few years, you can clearly see this difference:

AT&T is currently paying a 6.38% dividend, where Facebook is paying a 0.00% dividend. You give up growth for income.

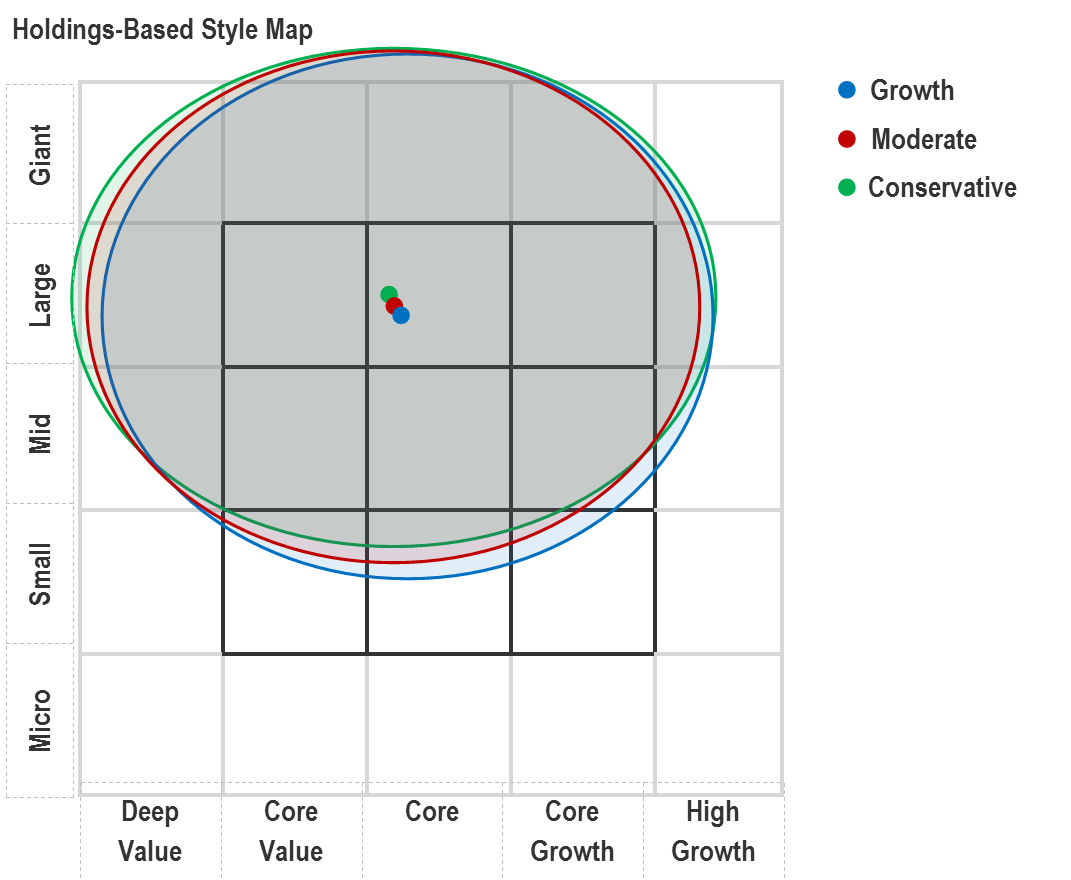

At Headwater Investments, our philosophy does not rely on individual stocks for our clients. What we do is build them a diversified portfolio over many asset classes using mutual funds and ETFs. The Morningstar Style Box can also be used to analyze individual mutual funds and even whole equity portfolios.

If you look at our model portfolios (the baseline allocations we use for analysis and starting points when talking with our clients), you can see they are pretty close. They are all pretty much in the middle of growth and value. What investors call ‘core.’ But they lean a little toward value. We like to tilt toward value companies because the majority of clients, retired folks and non-profits, are looking for more safety and income, versus maximizing return at higher risk.

The Morningstar Style Box can be a useful tool for analyzing portfolios, stocks, and mutual funds. This is an analysis we can run on any portfolio, so let us know if you are interested in seeing where your portfolio falls in the Morningstar Style Box. Contact us for an appointment today.

Source: Morningstar