Phone: 503-565-2100 ![]()

Mortgages in Retirement

Submitted by Headwater Investment Consulting on November 4th, 2015By Kevin Chambers

Many Americans are carrying mortgage debt into retirement. Although not always a bad thing, it is another payment to worry about for those living on a fixed income. The trend in recent years is showing an increase in levels of retirees with mortgage payments. Let’s look at what that might mean.

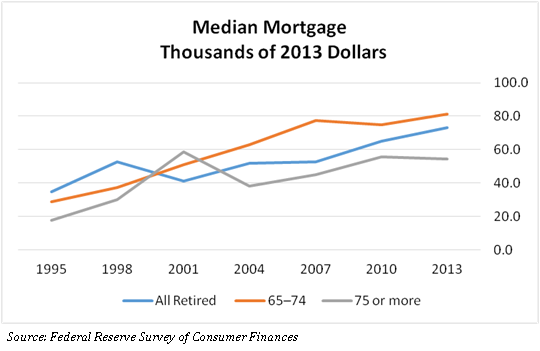

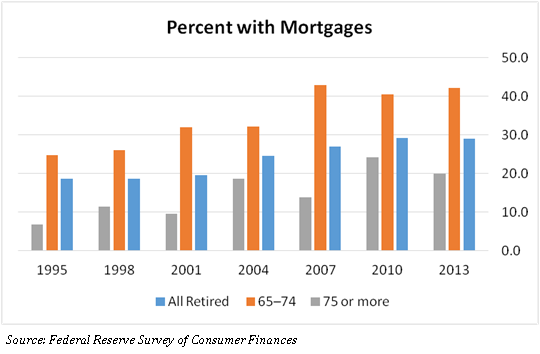

Over the decades, consistently 80% Americans age 65 and older have owned homes, making this the age group with the highest home ownership levels[1]. What has shifted is the level of debt for this age group. In the last 20 years, more Americans are entering their retirement years with mortgage debt, and at higher levels than previous generations. In 1995, about 19% of retired people had a mortgage, as of 2013 that grew to 29%. Additionally, the median mortgage balance rose over 100% to $73,000. For Americans over 75, the growth is even more substantial: 7% of Americans age 75+ had a mortgage in 1995, vs. 20% in 2013. The median mortgage balance for those seniors rose from around $18,000 to over $54,000. That is over a 200% increase in under 20 years.

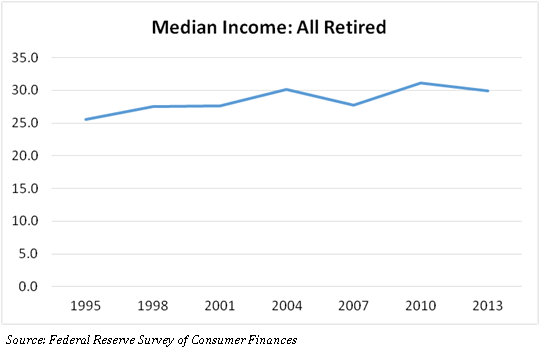

The higher mortgage rate is concerning because most retirees live on a fixed income. Some receive benefits from a work sponsored retirement plan like a 401(k) or a pension, and most receive a payment from social security. Over the same period that mortgage rates and balances have been increasing, retiree income has been fairly flat. From 1995 to 2013 median incomes of retired Americans has only increased from $25,500 to $30,000. That leaves more mortgage payments digging into a stagnant pot of money.

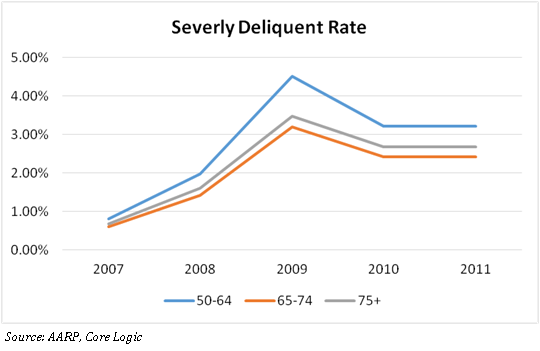

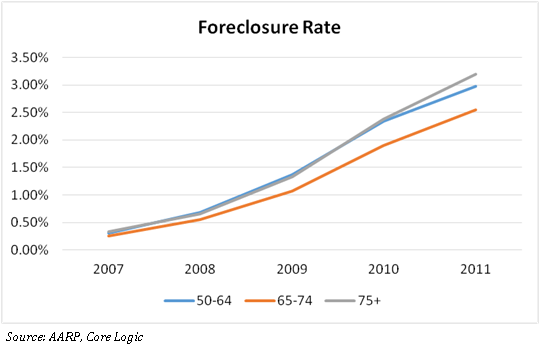

Historically, many Americans relied on their house as an important source of equity going into retirement. Many retirees plan on downsizing into a smaller home and using some of the extra equity for living expenses, or to finance healthcare costs. However, a mortgage on this asset in retirement opens up this valuable asset to the risk of foreclosure. This is especially true in times of financial turmoil. Until recent times, Americans over 50 have had very low foreclosure rates. During the 2008 crisis, foreclosure rates for older Americans spiked. In 2007, at the start of the real estate crash, Americans older than 65 had a foreclosure rate of about 0.3%. This steadily rose through 2011 to close to 3%. Meaning, 3% of retired Americans lost one of their most valuable assets they may have been counting on. While, younger Americans who go through the foreclosure process have time to get back on their feet and restart their lives, most retiree’s don’t have that option.

Obviously every person’s situation is different, and not all people have an income restraint going into retirement. It is important to talk with a financial professional and get advice for what is best for you. However, going into retirement with debt is a difficult proposition for two main reasons: it eats into a share of your fixed income, and the recovery from foreclosure is more difficult. In retirement, not having a mortgage means there is one less bill you have to pay, especially if you are on a fixed income. Financial crises and housing market crashes are unpredictable. If a crash does happen, it is better to own the equity in your house, instead of losing everything by going underwater on your mortgage. It is also nice for the peace of mind going into retirement knowing you can enjoy it debt free.

[1] Consumer Finance Protection Bureau data