Phone: 503-565-2100 ![]()

Negative Interest Rates

Submitted by Headwater Investment Consulting on February 17th, 2016By Kevin Chambers

If the news stories circulating in the United States are correct, we might start to see negative interest rates. From Bloomberg: “The Probability of Negative US Rates Is on the Rise” (Scaggs, 2016). From CNBC: “Negative Rates in the US? Here’s Why It Could Happen” (Cox, 2016). After 2008, central banks and governments have tried many creative tools to try and jump start economies, but a new movement to negative rates is unprecedented. Japan announced at the end of January that they were following the European example by lowering their interest rates below zero.

Basic Economic Theory:

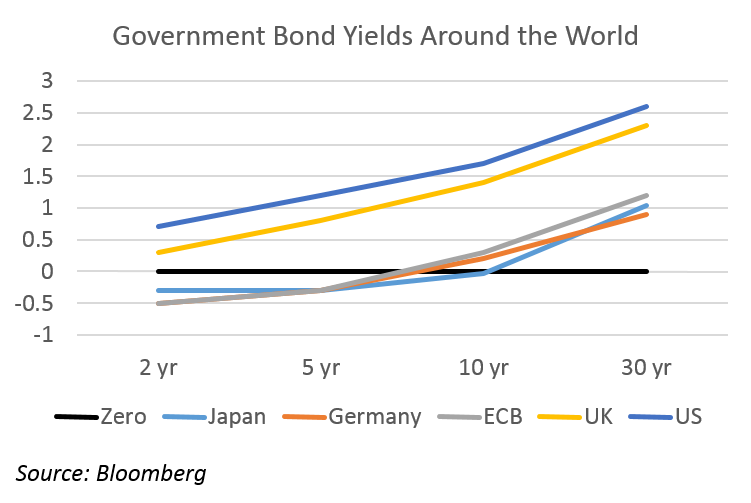

Bear with me as I put on my economist hat to explain the basics of this strategy. Europe and Japan are still trying to combat recessions. Just like the United States, they cut their interest rates to zero, and their central banks bought massive amounts of government bonds. For the US, this strategy was quite successful. Successful enough that the Federal Reserve decided to start the process of raising interest rates. Unfortunately, these measures have not worked across the oceans. Europe and Japan are still facing deflationary pressure, including falling prices.

During deflation, many people do not spend their money. If they expect prices to be lower tomorrow, why buy something today? During these periods, governments want to give people incentives to spend money, and this is where negative interest rates become a tool. Negative interest rates essentially make people pay banks to keep their money. Instead of the bank paying the depositors interest, the depositors pay the bank interest. This allows banks to lend out money at even lower rates for people to buy houses, cars, and other goods. Companies can use the incentive to buy equipment, buildings, and invest in research. Negative interest rates can also stimulate exports by devaluing the home currency. As a result, the central banks hope the negative interest rates will stimulate the economy, and start the countries back on a cycle of growth versus decline. This approach might seem like central banks are grasping at straws, but we are living in desperate times.

In the US:

Negative interest rates are unlikely in the United States. The US economy is arguably doing the best of any of the major developed nations. Unemployment is low, the housing market is continuing to recover, and most major companies are releasing positive financial statements. The Fed is currently trying to raise rates, not lower them. The articles claiming that negative interest rates are coming to America are really pointing to the possibility of a US recession and the lack of options for the Fed. If the US does fall into a recession, spurred by a lack of global growth, then the Fed would have no option but to let interest rates fall back to zero and possibly dropping them below zero to encourage spending.

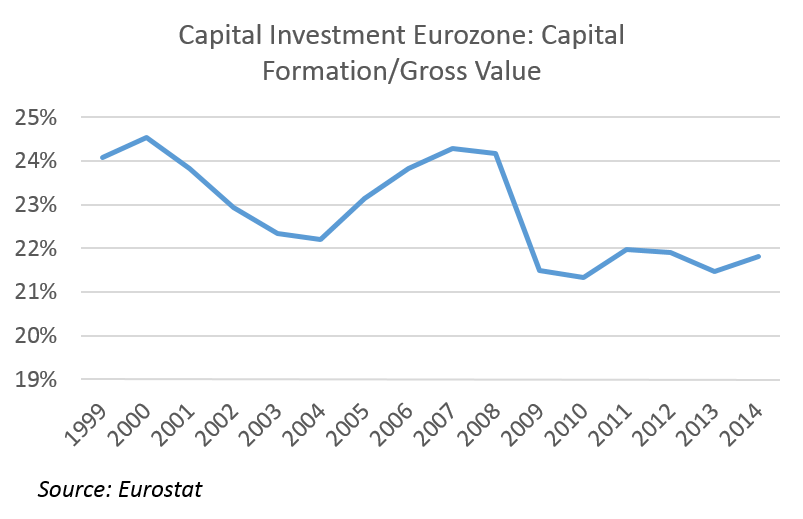

William Poole, former president and CEO of the Federal Reserve Bank of St. Louis, argued in the Wall Street Journal that lowering interest rates below zero has a payoff in the short term, but in the long term, the strategy could cause damage. Poole is concerned with all developed countries devaluing their currencies and creating a negative currency cycle that hurts everyone. He also brings up a concern that negative interest rates don’t encourage investment by companies, rather it convinces them to hunker down. He points to the stagnating capital investment rate in Europe. With negative interest rates for a year and a half, there has been no significant increase in capital spending by corporations.

The possibility of negative interest rates in the US is very much tied to the success of the overall American economy. The only scenario in which the Fed would consider negative rates is if they have no other options. Currently, it looks as if the US economy will continue to muddle through these tough times. Globally, the US looks the strongest with the most positive indicators. Although the stock market has faltered recently, the base economy is fairly solid. It is an interesting time in Central Banking as global thought leaders try to come up with creative solutions to unprecedented challenges. We will watch the negative interest rate experiment in Europe and Japan, however, it is unlikely to be a reality in the United States.