Phone: 503-565-2100 ![]()

Recent Market Volatility

Submitted by Headwater Investment Consulting on August 25th, 2015By Kevin Chambers

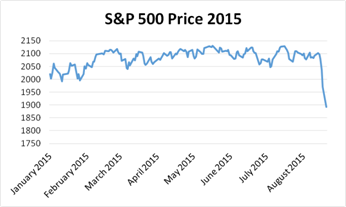

So far this year the stock market has been performing poorly. Year to date through August 24th, the S&P 500 is down over -3%, and the last 3 months it is down over 7%. The market has been fairly volatile. Investors are worried about a few different risk factors. On August 24th the market dropped 4% in one day, to rebound another 2% on the morning of the 25th, and slide back down to -1.4% for the end of the day. This summer the Chinese stock market has been sliding down after worries about slowing growth. The instability has started to spread to other Asian economies. The continued decline of global commodity prices, especially oil also has investors on edge. Finally, the US Federal Reserve is still keeping the markets in the dark about when they will increase interest rates. All of these factors have made markets touchy to financial news making prices swing day to day.

Source: Yahoo

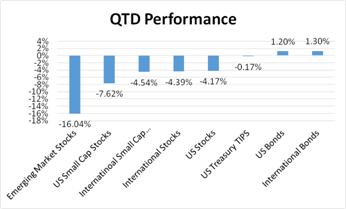

So what does this mean for your portfolio? In times of market volatility a natural response is to want to sell out of stocks. But that is usually the worst option for long term investments. The best thing to do when markets are volatile is to hunker down and not try to move very many assets. The current market conditions are showing that diversification is working. So far in the third quarter of 2015 risky investments have done poorly. Stocks across the asset classes have lost money. Bonds, on the other hand, have increased slightly over the quarter.

Source: Morningstar; As of August 24, 2015

Over time diversification creates less volatility. It dampens the impact of market corrections, however limits the investors potential gains. An aversion to the stock market during volatile market cycles will limit potential gains even more. Although it is hard to watch the financial news and see negative returns, it is important to remember that investments are for the long term. A globally diversified portfolio is the best way to achieve success long term, but sometimes it takes patience and resolve. Going forward we do not see any reason to change your investment allocation. Please let us know if you have any questions, we would be happy to talk with you further.

For more information about the risk factors currently in the market please read Kevin’s recent Blog Post and Research Papers:

Commodities: Click Here

Chinese Stock Market: Click Here

Federal Reserve and US Market Update: Click Here