Phone: 503-565-2100 ![]()

Required Minimum Distributions

Submitted by Headwater Investment Consulting on December 2nd, 2015By Kevin Chambers

IRAs, 401(k)s, and 403(b)s are excellent investment accounts to save for retirement. They are effective because as they grow, the owners do not pay taxes on the earnings. However, when money is distributed out of the account, the owner pays income taxes on the entire distribution coming out of the account. Furthermore, because the IRS has never taxed money in most retirement account, the IRS doesn’t allow money to stay in the accounts forever.

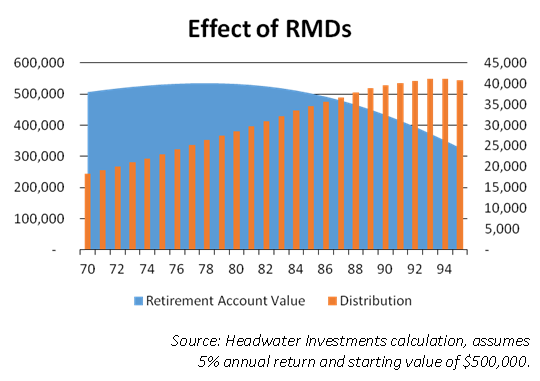

When account owners reach the age of 70½, they are required to take out a minimum proportion of the total account value of each retirement account*. This minimum proportion increases every year to force more out of the account. Owners can withdraw more than the minimum amount. The amount required to be distributed starts at about 3.5% based on the value on December 31st of the previous year and slowly increases each year.

If the retirement account owner doesn’t take enough withdrawals, they will owe a 50% federal excise tax penalty on the difference between the amount they withdrew and the amount they should have withdrawn. That is a very steep price for missing a distribution.

Headwater Investments manages the distributions for many accounts. There are many ways to meet the requirement. Some clients like to spread the distribution throughout the year, taking monthly distributions. Other clients prefer to take one lump sum distribution. If you have any questions about your RMDs, please feel free to stop by or give us a call.

* Roth IRAs are treated differently; the funds deposited to a Roth IRA are already taxed, so distributions from a Roth IRA are not taxable income. Moreover, the IRS does not require distributions to be taken from this type of retirement account.