Phone: 503-565-2100 ![]()

Target Date Funds

Submitted by Headwater Investment Consulting on April 13th, 2016By Kevin Chambers

A target date fund is a type of mutual fund found in many 401(k) plans. Target date funds are useful and popular long-term investment options. They are considered a “one-stop shopping fund.” One target date fund has a mix of different asset classes: US stocks, international stocks, US bonds, and international bonds.

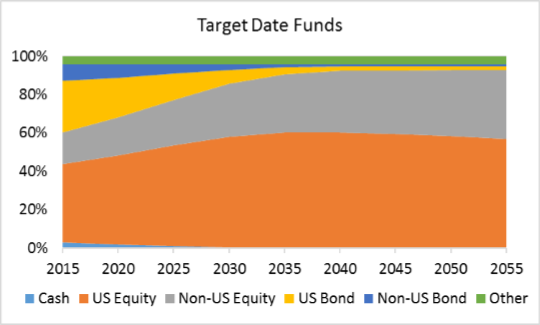

Each fund has a year associated with it. The year designates your expected retirement year and is often placed at 5-year intervals. As an investor, you choose the fund closest to your expected retirement. The unique aspect of target date funds is that the mix of assets changes over time. As you get closer to retirement, the fund shifts away from stocks to include more fixed income.

For example, a 2015 target date fund, the fund used by people retiring soon, would be about 40% bonds and 60% stocks. This differs with a 2050 target date fund, used by a new hire, that has 95% stocks and 5% bonds.

These funds are very popular because investors, especially those in 401(k) retirement plans, can set them and forget them. They don’t need to worry about creating a mix of investments that is appropriate for their situation, the fund does it for them. The managers of the fund are constantly rebalancing and adjusting the mix. Additionally, these funds are usually fairly inexpensive. The average target date fund cost 0.43%, well below the total mutual fund average of about 1%[1].

Target date funds are very good for smaller accounts, and can give access to a variety of asset classes through only one product. However, they do not allow for any substitutions or tweaks based your own risk tolerance. Some investors prefer to be a little riskier and have more money in the stock market, while others may be more risk adverse. While target date funds are good tools for growing wealth during accumulation and while you are working, they may not meet your needs as well once in retirement.

Every company’s version of the target date funds is a little bit different, and it is important to know what you are investing in. The funds have varying expenses and asset mixes. If you have any questions about your 401(k) plan or target date funds, feel free to give us a call or drop by the office.

[1] From Vanguard