Phone: 503-565-2100 ![]()

Why is the Dollar So High?

Submitted by Headwater Investment Consulting on March 16th, 2016By Kevin Chambers

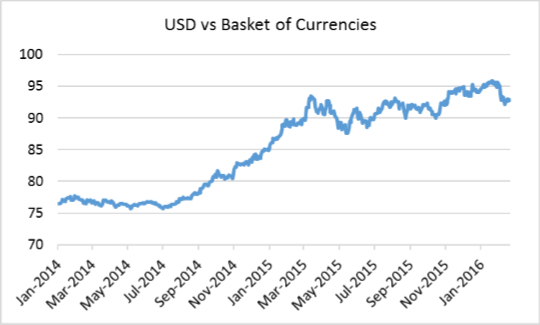

The US dollar is at its highest point in over a decade. Since June 2014, the value of the dollar has risen by 22%[1]. Let’s look at how a nation’s currency gets valued and why is the dollar been rising.

Source: FRED

How do currencies get valued?

The value of any currency is always relative to other currencies around the world. Currency fluctuations are monitored primarily for foreign trade purposes. As a currency value increases, it makes a country’s exports more expensive and makes imports cheaper. Higher currency prices tip the balance of trade (the ratio of imports to exports) toward importing more goods than are exported.

Factors that Influence Exchange Rates[2]:

Interest Rate Differentials:

Since bonds are denominated in local currencies, the purchasing of bonds is a driver of exchange rate changes. As interest rates increase, more investors are likely to buy those bonds to get the higher yield.

Economic Stability:

The relative health of an economy will lead investors to favor one country over another and draw investment funds into that country. Political or economic troubles would make investors less likely to invest in a country.

Current-Account Deficits:

The current account for a government is the balance of trade between other countries. Countries are considered to be running a deficit if they are spending more on foreign trade than they are earning. Therefore, during a deficit, the country is getting less foreign currency than they are sending into the world, creating depreciation of the home currency.

Public Debt:

Countries with high public debt, or large-scale deficit spending, can cause investors to shy away from buying their bonds. Acting like an inverse to the interest rates, large public debt means less foreign investors buying securities.

Why is the Dollar High?

In 2015 and 2016, there are two main factors that are influencing the dollar.

Source: Bloomberg

Right now, the US has higher interest rates than most other countries in the world. This means international investors are buying US bonds to get the higher yield. This has caused an influx of demand for US dollars to purchase these securities. The other main factor is economic stability. The US is one of the strongest economies in the world. As a global slowdown dims the prospects of most developed countries, and low commodity prices have depressed emerging markets, the US economy looks the strongest. This means foreign money is flowing into the United States. It also means that US investors are less likely to look abroad for investments. All of these factors are contributing to keeping the dollar at a high value.

[1] FRED data against a basket of currencies

[2] Van Bergen, J. (2014). 6 Factors That Influence Exchange Rates. Alberta: Investopedia.