Phone: 503-565-2100 ![]()

Will the Dollar Stop Being the Reserve Currency?

Submitted by Headwater Investment Consulting on March 23rd, 2016By Kevin Chambers

Reserve currencies are those held by central banks and financial institutions to pay for goods, pay off debt, and for speculative purposes. This allows countries to use the international currency freely, without having to exchange their home currency. The currency that nations hold more than any other is given the title of “The Reserve Currency,” or the currency that dominates foreign trade.

By the very nature of sovereignty, each nation has its own currency; however, it can be very useful to have a main reserve currency in which to complete transactions with other nations. Throughout history, there have been many dominant currencies. During the height of major empires, i.e. Romans or Byzantines, most of the rest of world transacted in their coin. During the Imperialism era, the balance of currency rule switched between the Portuguese, Spaniards, Dutch and French. Starting in the early 19th century, the British Pound Sterling became the reserve currency of choice. London became, and continues to be, a center for world trade. After the conclusion of WWI, the United States began their current economic reign, and the world switched to using US dollars.

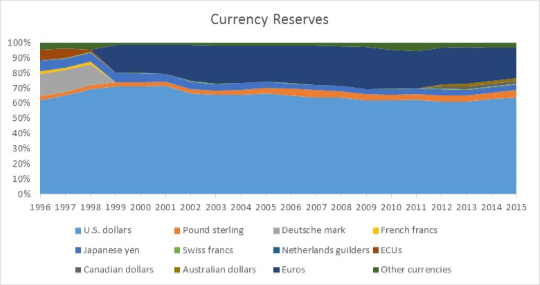

For the last 70 years, the US dollar has continued to be the world’s reserve currency. In the 1980s, the rise of Japan and Germany gave some of the shares to those countries. Then in 1999, with the creation of European Union, the Euro has risen to some prominence. Currently, the Euro makes up about 20% of total reserves; the pound makes up 5%, the yen 4%, and the US dollar 64%.

Will the US lose this dominance? Probably not anytime soon. This is mostly due to no other viable alternative. The Euro would be the most plausible candidate; however, with instability in that region, it seems unlikely to gain much more than its current percentage. Next, many people talk about China as a viable alternative, especially when dealing with commodity transactions. This is also unlikely. International traders and governments are not going to want to hold a currency that can be easily manipulated by the home government. The Chinese government has shown too much of a propensity for changing and muddling with their currency, especially recently with their economic turmoil. Until the Chinese can let go of their control of the Yuan, it is unlikely to become a major global player.

Considering the overriding current economic situation around the world, investors and governments are even more eager to hold US currency. The US economy is looking stronger than most of the world, our interest rates are some of the highest for developed countries, and the price of oil looks to remain depressed. All of these factors will continue to keep the price of the dollar high and keep the demand for dollars strong.